Strategic Litecoin Acquisition: Timing, Cost-Averaging, and Gradual Buying

When acquiring digital assets, the timing of a purchase can be as crucial as the platform or method used. For an asset like Litecoin, which has a history of significant price fluctuations, a strategic approach to timing can greatly influence the overall cost basis and potential returns. Understanding market cycles and historical patterns is a key first step for any investor.

Litecoin’s volatility presents both challenges and opportunities. Historical data reveals specific market cycles that may offer strategic entry points. Rather than attempting to predict exact price bottoms, a more measured approach involves identifying broader periods of potential accumulation.

The Impact of Purchase Timing

Price movements in the digital asset market are often cyclical. These patterns are influenced by technical factors, market sentiment, and network-specific events. For Litecoin, one of the most significant recurring events is the halving.

The Halving Effect

Approximately every four years, the Litecoin network undergoes a “halving.” This process is hard-coded into its protocol and reduces the block rewards paid to miners by 50%. This reduction slows the rate at which new LTC enters circulation, increasing the asset’s scarcity over time.

Historically, halving events have had a noticeable impact on price. Data shows that prices have often rallied in the months leading up to a halving. This is followed by a “post-halving consolidation” phase, where prices may experience a significant pullback, sometimes retracting 18% to 32% from recent highs. This period can present an opportunity for gradual accumulation.

Navigating General Volatility

Beyond scheduled events, the Litecoin market is subject to broader volatility. This includes periods of extended downtrends, which have seen price drops of 65% to 85% from cycle highs, and brief but sharp “flash crashes.” These moments test an investor’s discipline.

Attempting to time the market perfectly by buying at the absolute bottom is exceptionally difficult. Instead, these volatile periods can be viewed as windows for implementing a structured buying strategy, which helps to mitigate the risk associated with making a single, large purchase.

A Disciplined Approach: Gradual Buying Strategies

To navigate market volatility effectively, investors can employ gradual buying techniques. These methods shift the focus from trying to “time the market” to achieving a favorable average price over an extended period. The most well-known of these strategies is cost-averaging.

The Core Concept of Cost-Averaging

Dollar-cost averaging (DCA) is an investment strategy that involves purchasing a fixed dollar amount of an asset at regular intervals. This could be daily, weekly, or monthly. The core principle is to smooth out the purchase price over time, reducing the impact of short-term volatility.

When the price is low, a fixed investment buys more units of the asset. When the price is high, the same investment buys fewer units. This approach may lead to a lower average cost per coin compared to a one-time, lump-sum purchase. One analysis indicated that investors using disciplined DCA for Litecoin outperformed lump-sum buyers by over 27% during a specific three-year market cycle.

Variations of the Strategy

While standard DCA is effective, some investors use modified versions to adapt to market conditions more dynamically. These approaches require more active monitoring but can enhance the basic principles of gradual buying.

- Value-Adjusted DCA: This method involves making larger purchases during significant price declines. It combines a regular buying schedule with opportunistic buys during market dips.

- Technical Trigger DCA: Instead of a fixed calendar schedule, purchases are triggered by specific technical indicators, such as the Relative Strength Index (RSI) or Bollinger Bands, signaling a potential entry point.

Putting Strategy into Practice

The goal of a gradual buying plan is to remove emotion from investment decisions. A structured approach helps prevent panic selling during downturns and avoids fear-of-missing-out (FOMO) purchases near market tops. This discipline is often what separates a well-managed entry from a reactive one.

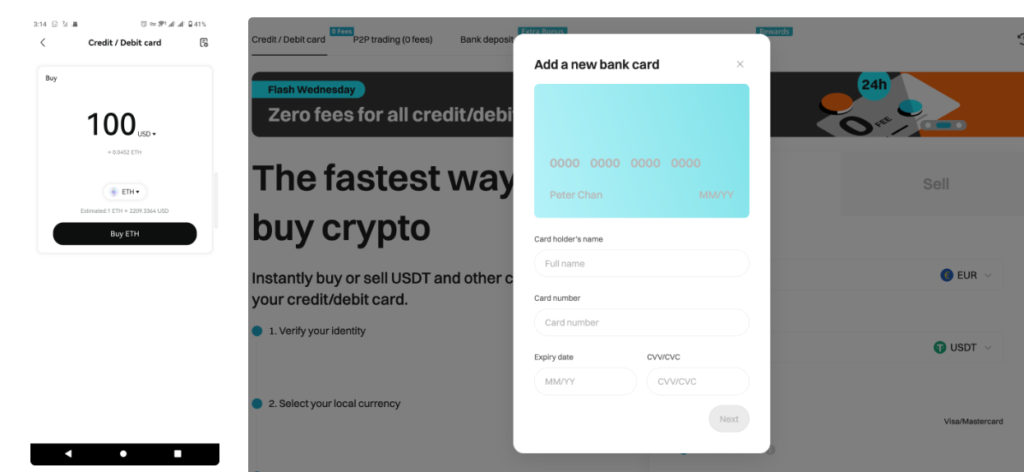

Implementing these strategies requires a clear plan and a reliable means of execution. After deciding on a gradual buying schedule, the next step is to understand how to buy litecoin through a process that aligns with your strategy. By breaking a larger planned investment into smaller, regularly scheduled purchases, an investor can build a position over time without being overly exposed to short-term price swings.

This approach is particularly suited for individuals with a long-term conviction in an asset. It acknowledges the difficulty of predicting price movements while providing a logical framework for accumulating a position at a potentially favorable average cost. Ultimately, a disciplined, gradual acquisition strategy can be a powerful tool for managing risk and building a solid cost basis in a volatile asset like Litecoin.